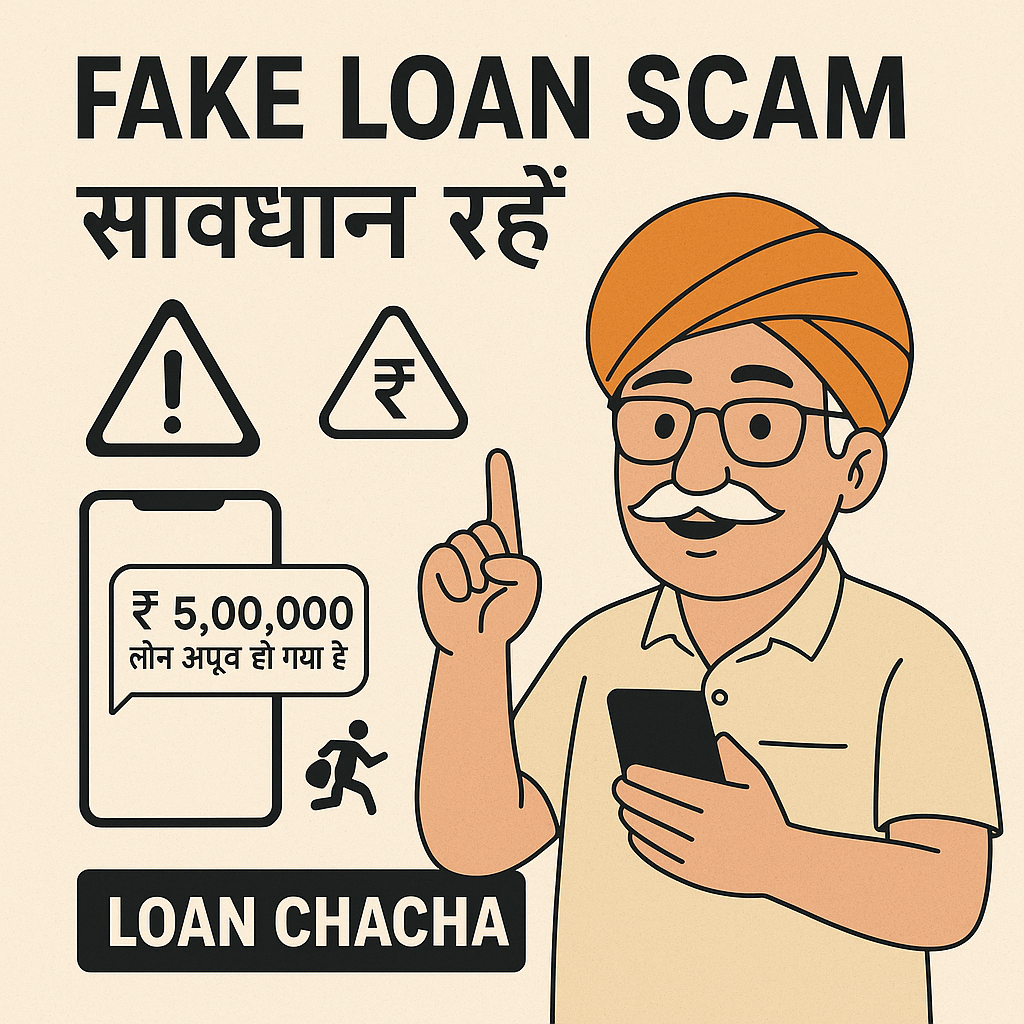

In today’s digital world, getting a loan has become easier, but along with that, the risk of fake loan scams has also increased. Many people, without proper verification, trust online links or phone calls and end up losing their money and personal data. Loan Chacha will tell you how these scams work and how to protect yourself from them.

What is a Fake Loan Scam? 🤔

A Fake Loan Scam is a fraud where scammers pose as agents of banks or NBFCs (Non-Banking Financial Companies) and offer you attractive loan deals.

They promise low interest rates, quick approvals, and no documentation checks, but in reality, their main goal is to take processing fees, insurance charges, or advance payments from you and disappear.

How Does a Fake Loan Scam Work? 🔍

- Fake Calls / Emails / SMS / Social Media Ads 📲

- Messages like “Sir, your personal loan of ₹5 lakh has been approved.”

- Tempting Offers 🤑

- Very low interest, no credit score check, instant approval.

- Collecting Documents & Advance Fees 📑

- They take your PAN, Aadhaar, bank details, and ask for ₹1,000–₹10,000 as a “processing fee.”

- Disappearing 🏃♂️

- After payment, their phone, email, and website vanish.

How to Identify a Fake Loan Scam? 🚨

✅ Be cautious of offers that seem too good to be true – No genuine bank will give a loan without verification.

✅ Check official websites and email IDs – Emails from Gmail, Yahoo, or similar domains are suspicious.

✅ Avoid public payment modes – Never transfer money to personal accounts via UPI, Paytm, or GPay.

✅ Verify on RBI/NBFC list – Ensure the company is registered with the RBI.

Tips to Avoid Fake Loan Scams – Loan Chacha’s Guide 🛡

- Always apply for loans through official bank/NBFC websites only.

- Never share OTP, ATM PIN, or passwords with anyone.

- Never pay processing fees in advance – genuine banks deduct them from EMIs.

- Check the NBFC list on the RBI’s official website.

- Report any suspicious call/email immediately.

Loan Chacha’s Message ❤️

Loan Chacha says –

“Dream big, take loans, but trust only genuine banks and NBFCs. Don’t let scammers become the enemy of your dreams.”

📌 Note: If you receive any fake loan offer, immediately file a complaint at cybercrime.gov.in and inform your bank.